We’re sure most of you are familiar with cashback sites. You know, the brave startups that offer you cashback when shopping on certain e-commerce sites. What if there was one who’d do the same for offline purchases, where the bulk of our spending goes?

Turns out there was already one in the works. CardPow is a fintech startup focusing on offering cashback to shoppers for virtually all offline transactions. It is kicking off this weekend, and it is inviting all Malaysians to test its platform.

Earning cashback is even more simple than it is on online cashback sites. Shoppers only need to snap a photo of the receipt onto the CardPow app, and if approved (there are some prerequisites), you’ll just need to wait a certain number of days before you can cash out.

The idea behind CardPow is simple. The startup pays you a certain percentage of your purchases as cashback, based on the amount shown in the scanned receipt. From these accumulated receipts, CardPow’s algorithms can then generate an accurate idea of your spending habits, and where do you go to spend your money.

The more extensive the data CardPow has, the more accurate the consumer behaviour profiles will get. For example, CardPow’s algorithms can identify which is your favourite shopping mall simply based on the number of receipts you have from that mall. The receipts will also be able to tell how often you eat out – data that will be useful for marketers.

The more receipts you upload, the more complete your consumer profile becomes. This data can eventually reveal which part of the city you stay in, a rough idea of your income, your hobbies and interests, and even your favourite types of food.

And it is this data that CardPow will generate sustainable revenue. Data pulled, anonymised, and sorted by various perimeters (location, income, and more) can then be pitched and sold to retail partners (such as shopping malls and its merchants) to offer invaluable insight on consumer behaviour, allowing them to tailor better promotions and campaigns for patrons.

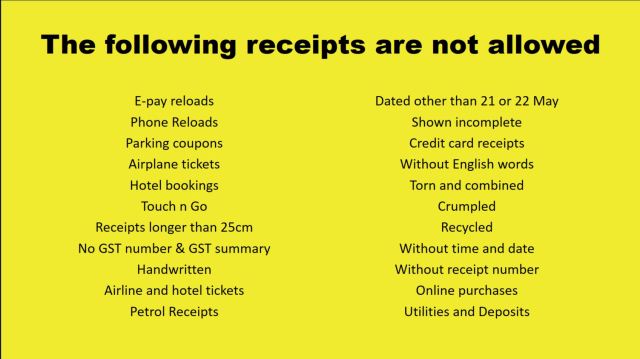

But before CardPow can do that, it’ll need data – lots of it. That’s where this weekend’s events will get the ball rolling. CardPow will offer cashback rates between 1% to 30% for virtually any and every purchase made on 21 and 22 May 2016. No minimum purchase amount, no maximum number of receipts. The only exceptions are listed below:

Users can then upload their receipts any time after that to the CardPow app (on Google Play; iOS version is said to be coming soon) or website. The app will also display a list of uploaded receipts, as well as their cashback status.

Unlike online cashback sites which run 24/7 but are limited to only a few e-commerce partners, CardPow’s cashback eligibility is limited to purchases made on a specific time frame – but (for now) there is no cap on maximum cashback. COO and co-founder, Sze Jun King states that CardPow will offer similar cashback windows like this weekend’s in future – and that CardPow will only offer them during weekends, when consumer spending is at its highest.

The idea may not be new, but CardPow’s offline cashback model is certainly unique in Malaysia. Head on to the official website to sign up or find out more.